Selling your home could lead to higher Medicare premiums if your taxable income sees a boost.

Although your Medicare benefits shouldn't change when you sell your home, your monthly premiums may. It depends on whether the sale of your home affects your taxable income.

Medicare doesn't limit enrollment based on income or resources the way that Medicaid does. High-income earners, however, do typically pay higher Medicare premiums. Less than 5 percent of Medicare beneficiaries fall in the "high-earner" category. If selling your home pushes you into one of these categories, you could join that select group.

What Is the High-Earner Threshold?

Medicare considers you a high earner if your modified adjusted gross income (MAGI) exceeds $97,000 per year if you file your taxes as a single, or $194,000 for married couples filing jointly (in 2023).

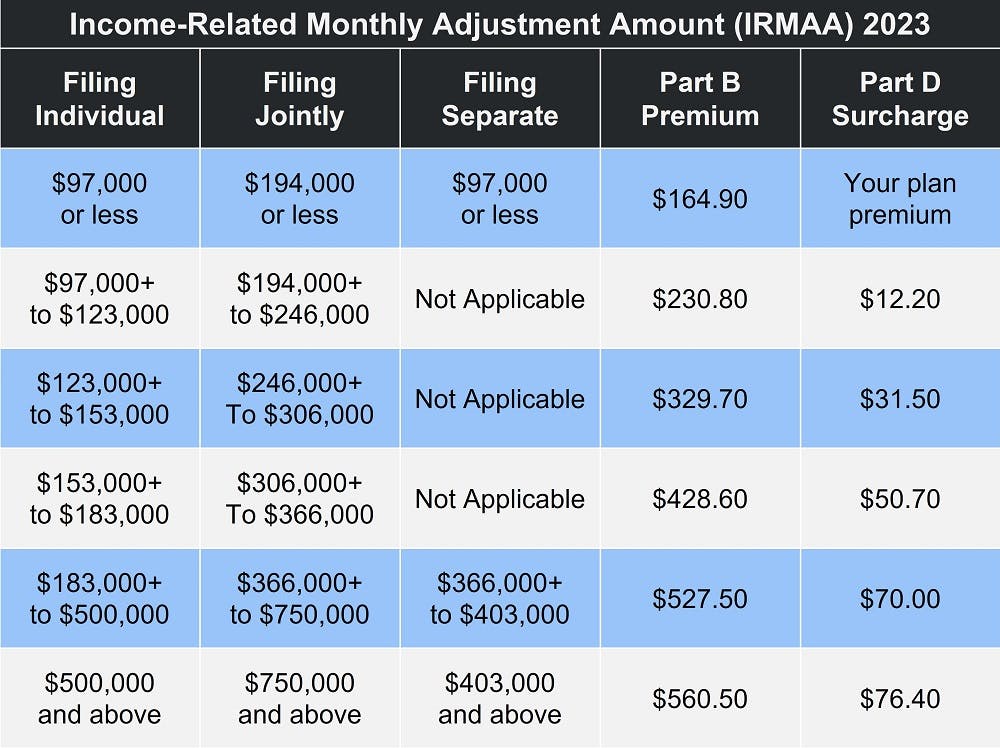

If your MAGI exceeds those thresholds, you'll owe the Income-Related Monthly Adjustment Amount, or IRMAA. You will likely owe the IRMAA surcharge for both Medicare Part B and Medicare Part D. Find your income level on the chart below to see what you'll pay for Medicare premiums:

The IRMAA decision is based on your income tax return from 2 years ago. So, your 2023 premiums are based on the reported income from tax year 2021 that you filed in 2022. The IRS forwards this information to the Social Security Administration (SSA) and that is who notifies you whether you owe IRMAA.

How Does Selling Your Home Affect Medicare Premiums?

The capital gains tax may apply when you make a profit on an investment, which includes the sale of real estate. Luckily, the IRS does allow you to exclude a portion of your capital gains on real estate.

- If you're single, you may exclude up to $250,000.

- Married couples who file jointly may exclude up to $500,000 for capital gains on real estate.

A home sale may increase your modified adjusted gross income beyond the standard premium thresholds. One exception is if this is the sale of your "final home" as the assumption is that you will not be reinvesting those proceeds into the purchase of a new home.

Because Medicare premiums are based on your tax return from 2 years ago, it is entirely possible you've experienced a permanent reduction in income during the interim. If you feel you should not owe the IRMAA surcharge, you may file an appeal with Social Security.

When Can't You Take Advantage of Capital Gains Exclusions?

It wouldn't be the U.S. tax code if there weren't limits to the real estate exclusion. If any of the following apply, you will have to pay tax on the whole gain, meaning it will count toward your MAGI:

- The home you sold was not your primary residence

- In the 5-year period before selling the home, you owned it for less than 2 years

- You did not live in the home for at least 2 years during the 5-year period before selling (unless you are in the military, have a disability, or work for the intelligence or foreign service community)

- You claimed the exclusion for another home sale during the 2-year period before selling this home

- You bought the home in the last 5 years with a 1031 exchange – changing one investment property for another

- You owe the expatriate tax

To be sure, you should always talk to a tax accountant.

Appealing the Income-Related Monthly Adjustment Amount

Although Medicare premiums are determined by the Centers for Medicare & Medicaid Services (CMS), the "Initial IRMAA Determination Notice" comes from the Social Security Administration. This notice describes how SSA determined you owe IRMAA and provides information on filing an appeal.

Generally, you must have experienced a qualifying life-changing event (LCE) to request a new initial determination. These are:

- The death of a spouse

- Getting married

- Getting a divorce or an annulment

- Experiencing a work reduction

- Work stoppage, such as retiring or being laid off

- Experiencing a loss of income from an income-producing property

- Experiencing a loss or reduction in pension income

- Receiving a lump sum employer payment

To file an appeal, complete form SSA-561-U2, Request for Reconsideration. You may also call SSA toll-free at 1-800-772-1213 or TTY 1-800-325-0778. Local Social Security offices have been closed since March of 2020 due to the Coronavirus, so online or telephone are your best options for reaching SSA.

How Long Does IRMAA Apply?

The good news is that an IRMAA determination doesn't mean you owe the high-earner surcharge forever. If your adjusted gross income dropped below the IRMAA threshold, you'll pay the standard Medicare premiums next year.

If I Sell My House, Will I Lose My Medicare Benefits?

Selling your home will not cause you to lose your Medicare benefits. However, if you have a Medicare plan and move to a new address, you may need to change your plan.

Original Medicare includes Parts A and B.

- Medicare Part A helps pay for inpatient care received in a hospital or skilled nursing facility (SNF).

- Medicare Part B covers outpatient services like doctor visits, lab work, mental health care, and more.

These benefits follow you throughout the United States. The only difference comes if you have Medicare Part C or Part D.

Medicare Part C is more commonly known as Medicare Advantage. These health insurance plans are provided by private insurance companies working under guidelines set by the Centers for Medicare & Medicaid Services. All Advantage plans must provide the same coverage you get with Original Medicare, but they are not limited to these benefits. Most provide additional services, such as prescription drug coverage and routine vision care.

Most Medicare Advantage plans have a provider network. They may also require members to live in a certain area. If you move outside that area, you will likely need to find a new Advantage plan.

Medicare Part D provides prescription drug coverage. You may join either a standalone Part D plan or a Medicare Advantage Prescription Drug plan (MA-PD). Many Part D plan requirements include not only a plan area but a pharmacy network. Again, moving outside this area may mean you have to join a new Part D plan.

Moving is one of the "special circumstances" that qualifies you for a Special Enrollment Period (SEP). You have at least 2 months to make changes to your Medicare plan when you move. Find out more on Medicare.gov.

Additional resources

Medicare.gov: Special Circumstances (Special Enrollment Periods)

External Website Link

Social Security Administration (SSA.gov): IRMAA Determination Notices

External Website Link

ClearMatch Medicare: Are Medicare Premiums Tax Deductible?

Internal Website Link

Speak with a Licensed Insurance Agent

Mon-Fri 8:00am-8:00pm | Sat 9:00am-5:00pm EST